Naccas loan calculatorįor example, fill out an application form which will ask about your personal information, financial status etc. An offset account linked to your home loan can lower the loan interest. The process of getting a loan online is simple and fast if you know what you need to do. As one of the big four banks in Australia, NAB provides some of the best options and features for expats and overseas borrowers. Use this calculator to estimate how much sooner you could pay off your loan, and how much interest could you save on your loan over time by using an offset. Part of the National Australia Bank Group (NAB), Advantedge Financial Services Pty Ltd. You can get approved for loans from various lenders. Find out more on how we can support you with your home loan. Loans are available to people with bad credit as well as those with no credit. This calculator can also be used to generate a key fact sheet for a NAB home loan commencing with a principal and interest period. If you have a low credit score and need money, getting loans online is a good option. Understand interest rates and minimum repayments based on your inputs. This article will give some insight on those things as well as how long it takes to receive your money after applying for the loan. You want to find a lender that has competitive rates and offers great service as well. There are many different types of loans that can be taken out and there is a good chance that one of them is right for you. Contact us on 13 11 82 with any questions, or visit your nearest branch to talk to a consultant.If you`re looking to get a loan online, we will help you with some of the best places to go. Home loan product, Interest rate p.a, Comparison rate p.a. Rounding out the major banks, National Australia Bank (NAB) has announced its standard variable home loan interest rate will increase by 0.25 per cent p.a. Before using this advice to decide whether to purchase a product, you should consider your personal circumstances and the relevant Product Disclosure Statement (PDS), other Disclosure Documents, and Target Market Determination (TMD). All the latest home loan rates from National Australia Bank (NAB). Any advice provided is general advice only and does not take into consideration your personal objectives, financial situation or needs ("your personal circumstances"). Important: Please check your individual State and Territory for relevant grants and concessions applicable to your location. Information such as interest rates quoted and default figures used in the assumptions are subject to change. Individual institutions apply different formulas. Results do not represent either quotes or pre-qualifications for the product.

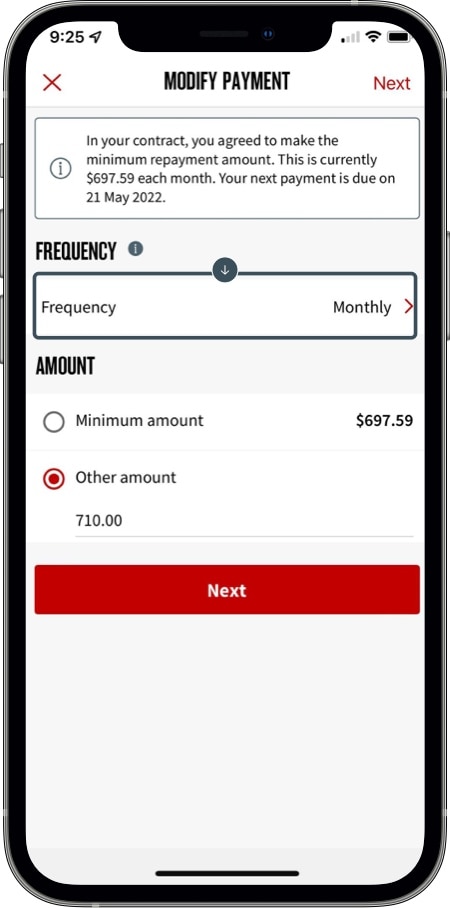

The results from this calculator should be used as an indication only. Please refer to your loan contract and the terms and conditions regarding additional repayments prior to making additional repayments. Different terms, fees or other loan amounts might result in a different comparison rate. WARNING:This comparison rate is true only for the example given and may not include all fees and charges. The comparison rate is for a loan of $150,000 over 25 years. Created with Highcharts 6.0.6 Years elapsed Loan Paid (Rs.) Personal Loan Chart Total Interest 0 1. The repayment amount is based on certain assumptions, should be regarded as indicative only, and is not a quote nor a pre-qualification for a home loan. You will have the ability to budget knowing your repayments. You will be protected against interest rate rises for the duration of the period. PMI Calculator: How Much Is Mortgage Insurance You can get a home loan with less than a 20 down payment, but youll probably have to pay for mortgage insurance.

Your minimum repayments won’t change during the fixed period. Terms, conditions, fees, charges and lending criteria apply and are available on application. Benefits The main benefit of a fixed rate home loan is certainty around your repayments.

0 kommentar(er)

0 kommentar(er)